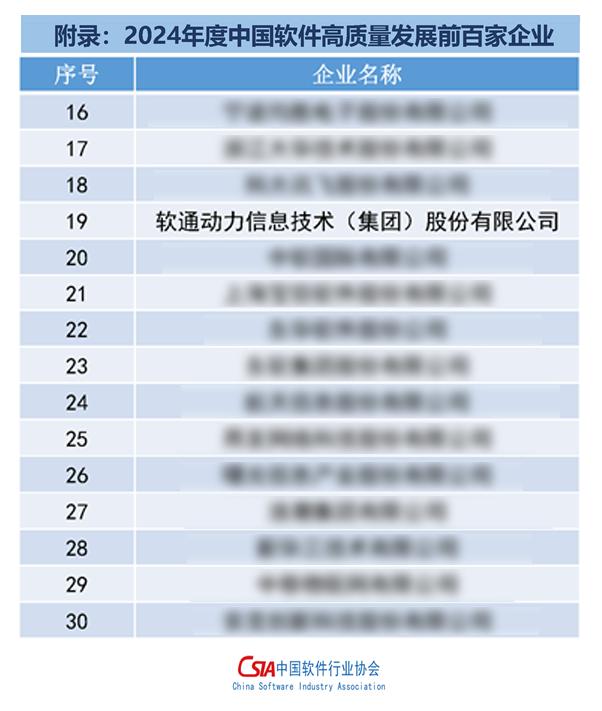

Insight ▏iSoftStone Releases SaaS Market Analysis Report: Rapid Growth, Prominent Fragmentation, and Consumption Concepts to be Transformed

Digital technology has become the "booster" of economic growth. Thanks to its strong scalability, high flexibility and fast iteration, SaaS provides effective support and guarantee for enterprise development. In the process of digital transformation, what changes will occur to corporate SaaS application scenarioses? Under the wave of technological innovation, who will be the next beneficiary? What are the development trends of the SaaS market?

Recently, the Research Report on China SaaS market and Development released by iSoftStone Innovation Research Institute believes that:

• Seizing the precious window period of rapid development in China

In the next 3-5 years, the SaaS market in China will transition to the mature stage of the industry. As a result, the overall market size is expected to reach RMB100 billion, and the competition will become white-hot. This period of time will be a valuable window for all stakeholders including traditional software vendors, entrepreneurial SaaS vendors, and Internet vendors.

• The fragmentation of user requirements will continue

The needs of SaaS users cover business management, data analysis, inter-office communication, information security, business processes, vertical dedicated uses and other categories. The management, production and functional departments other than IT departments become the initiators of demand.

• User concepts and consumption habits still need to be cultivated

The penetration rate of SaaS users is 43%, but that of paying users is only 5%, indicating that user’s acceptance and trust still need to be improved. SaaS vendors need to help users update their cognition from the perspectives of product experience, security and credibility, intellectual property rights, etc., so as to enhance their willingness to continuously pay for the services.

• Integration is an important direction for the development of the SaaS market

Simple SaaS products are difficult to build a defense wall for enterprises, and integration is the general trend: at the product level, service providers can extend to PaaS and even IaaS levels to create a product matrix that meets the needs of customers at different levels; at the commercialization level, they can also make a wise move to build enterprise-level SaaS products by relying on a large ecosystem alliance.

The SaaS market is developing rapidly, and the competition pattern is not stable

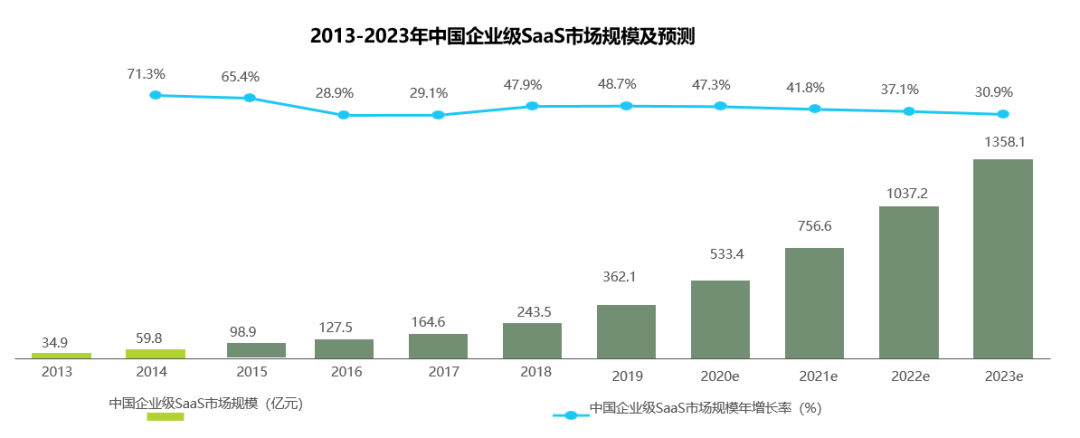

The rapid development of cloud computing and the improvement of bottom layer cloud services have paved the way for the development of SaaS. At the same time, policies continue to encourage "enterprises to move to the cloud", promote user education, increase enterprises' acceptance of SaaS and the demand for industrial digital transformation, and promote the rapid expansion of China's SaaS market scale, even exceeding expectations.

In 2019, the size of China's enterprise-level SaaS market was RMB36.21 billion. It is expected that the size of the market will exceed RMB100 billion in 2022.

According to industry consensus, SaaS business application scenarioses are divided into six racetracks, namely: operations management, inter-office communication tools, business process outsourcing, data analysis services, information security services and vertical industry applications.

According to the data of HAP Academy, the number of SaaS vendors in China will reach 4,500 in 2020. Among them, the number of SaaS vendors in operations management is the largest, accounting for 31%; followed by inter-office communication tools and vertical industry applications, both accounting for 21%; in contrast, the number of SaaS vendors of data analysis services and information security services is slightly smaller, accounting for 6% and 4%, respectively.

From the perspective of the market size of SaaS segments under different business scenarioses, the market share of operations management is the highest, accounting for 40%, with a size of RMB20.06 billion. Followed by vertical industry applications, with a market share of 26% and a size of RMB13 billion.

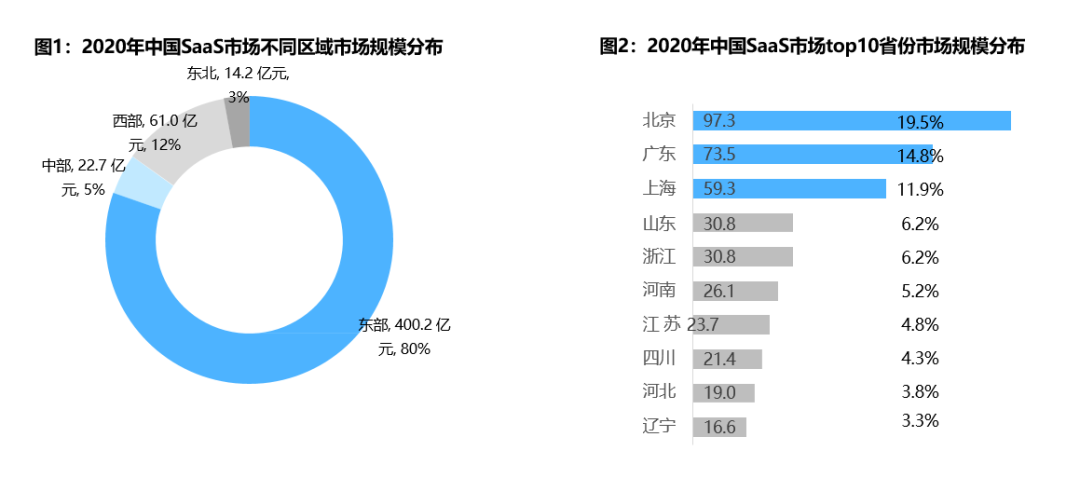

From the perspective of SaaS segment market size in different regions, the market size in the East China is the largest, reaching RMB40.02 billion, and accounting for 80%; followed by the West China, with a market size of RMB6.1 billion, accounting for 12%; the market size in Central China is RMB2.27 billion, accounting for 5%; the market size in Northeast China is the lowest, with RMB1.42 billion, accounting for only 3%.

From the perspective of SaaS market size in different provinces, Beijing, Guangdong, and Shanghai are the top three market segments, followed by Shandong, Zhejiang, Henan, Jiangsu, Sichuan, Hebei, and Liaoning.

In terms of the number of SaaS users, the number of SaaS users has reached 9.15 million, accounting for 43% of the number of legal persons in China. In terms of the number of SaaS paying users, there are 1.02 million paying users, accounting for 11% of SaaS users. It can be seen that there is still much room to improve the penetration rate of SaaS, and the market competition landscape is not stable.

Brief summary:

We believe that despite a large gap in the application and development of SaaS between China and the international leading markets, with the deepening of the development level of enterprise information and cloud services, as well as the continuous support by national policies and regulations, the acceptance of SaaS applications by Chinese corporate customers has already been unleashed, and the application areas are becoming wider and wider. The development of SaaS in China will gradually enter the mature stage from the growing stage, and the market competition will be even more intense! For SaaS enterprises, it is both a challenge and an incentive. Reasonable competition can enable SaaS enterprises to have broader development prospects.

SaaS products bloom in many aspects, and vendors actively spur innovation

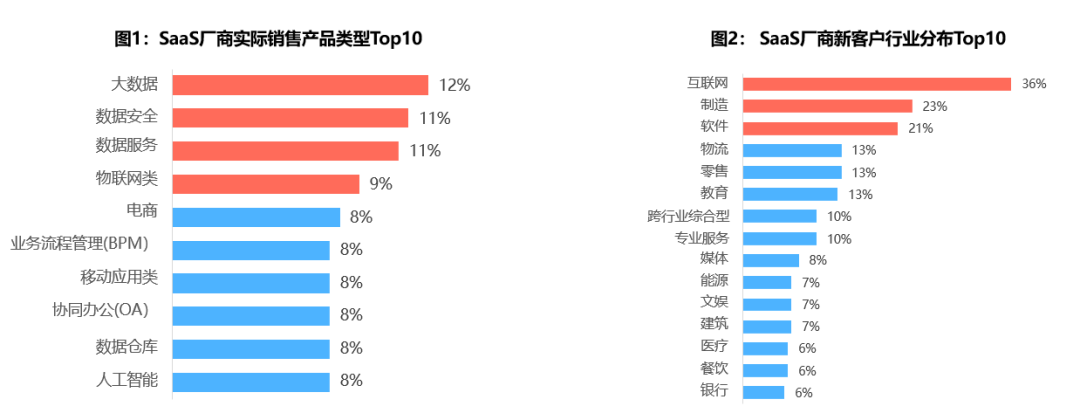

In recent years, the SaaS industry in China is catching up with international peers in terms of product concept, market maturity, payment habits, per customer transaction and other aspects. According to the analysis, shows that from the top 15 popular product types supplied by manufacturers, data, e-commerce, R&D management, IoT, security, middle platform, and OA are among the top 15 popular product types from vendors.

The types of popular products in different segments are different: the popular products in operation and management are e-commerce, R&D management, equipment and asset management, ERP, etc.; popular products in data analysis services are big data, data services, and data warehouse; popular products in inter-office communication tools are OA, video conference, design and image, office and document management; popular products in business process outsourcing include enterprise training, employee welfare, bookkeeping agency, etc.

SaaS vendors mostly provide 4-10 products, and the mainstream business is still operation and management products, accounting for 83%; followed by data analysis services, accounting for 51%; the third is inter-office communication tools, accounting for 41%. At the same time, vendors are more vigorous in launching cutting-edge products, mainly focusing on data security, big data, mobiles applications and e-commerce in key industries such as Internet and manufacturing.

From the perspective of the distribution of per customer transaction of SaaS manufacturers, the proportion of RMB50,000-100,000 is the highest, up to 27%; followed by less than RMB20,000 and RMB20,000-50,000, both of which are 16%. It can be seen that 58% of SaaS vendors have a per customer transaction of less than RMB100,000. From the perspective of customer types, most of the customers of SaaS products is still small- and medium-sized enterprises, accounting for 73%, which are the main force purchasing SaaS products.

From the perspective of industry distribution of SaaS users, the industries with a high proportion of SaaS users include manufacturing, Internet, software, energy, transportation, and professional services. Among them, manufacturing and Internet account for the highest proportion, both accounting for more than 21%; followed by software, accounting for more than 10%; the proportion of energy and transportation is also relatively high, both accounting for about 5%. It can be seen that SaaS users is highly concentrated in the industry, with the top four industries accounting for nearly 60%. Therefore, SaaS vendors should focus their energy on these four industries.

Brief summary:

We believe that on the supply side, a significant share of SaaS vendors in China are obviously start-ups, with more than 30% of them being established in recent five years. A large number of new vendors pour into the industry every year, indicating that capital is optimistic about the prospects of the industry. However, on the other hand, small players in the industry are scattered while large ones are not strong. 56% of vendors generate revenues less than RMB20 million, and 49% of vendors make profits less than RMB5 million. While a large number of new entrants divide up the market, they also substantially reduce the profitability of the industry, requiring SaaS vendors to seek more diversified profitability models and monetization ways. Therefore, iSoftStone Innovation Research Institute believes that when it comes to product positioning, SaaS vendors should choose general or customized products as their featuring products on the market: general products have a low per customer transaction and relatively slow growth rate, but their gross margin is high. When a vendor has survived the forbearance period in the early stage, it can make rapid progress in the later stage and enjoy a decent compound interest growth. With a slightly lower gross margin, customized products are meant to serve large customers, but they have higher per customer transaction and are easier to secure orders. Therefore, vendors can expand their presence in the early stage and continuously improve their productization rate and gross margin in the later stage.

Systemic changes in the SaaS industry deeply integrated with eco-partners

With the digitization of the Chinese market transitioning to the digital intellectualization era, the clear-cut division of IaaS, PaaS and SaaS in the past can hardly meet the digital intellectualization needs of diversified and fragmented scenarioses in enterprises, and the development of the SaaS market has entered a new integration period.

Integration includes not only the integration of SaaS, IaaS, and PaaS, but also the integration between eco-partners. To further improve the public cloud coverage and expand its market share at the business end, vendors began to go upwards and build the SaaS ecosystem alliance brand.

Cross-over Internet vendors leveraged their technical expertise in the IaaS layer to build aPaaS application market, to give SaaS products stronger scalability and customizability, and then established the SaaS ecosystem around competitive products from three levels: independent R&D, investment and M&A and ecological cooperation. On the one hand, as the integrated party, it provides technical support for entrepreneurial SaaS vendors; on the other, it also gives play to its advantages in traffic and capital to activate the use intention of small and micro enterprises with free or low-cost SaaS products at this stage.

For large-scale entrepreneurial SaaS vendors who have withstood the test by technology and have an increasingly complete business architecture, they begin to accelerate scale expansion and industrial M&A. For the leading start-up SaaS vendors, there are two main M&A directions: the first is vertical M&A, which involves acquiring and merging PaaS layer vendors at the upstream of the industrial chain to strengthen SaaS vendors’ capabilities to build aPaaS platforms and develop IaaS-level technologies, and to build their own public cloud; the second is horizontal M&A, which involves acquiring and merging vendors focusing on innovative business and segmented business to maintain the vendors’ own technological innovation capability and enhance their monopoly power and adjusting and supplementing their existing business architecture to build an enterprise-level SaaS product ecosystem and achieve the optimal economic scale. In combination with the development process of developed markets, SaaS enterprises with a certain foundation will see a golden period of development in the next 3-5 years. The leading vendors on each racetrack will establish a highly available aPaaS platform. After that, there will emerge many SaaS products targeting more market segments. By then, the SaaS market in China will be completely activated.

Brief summary:

We believe that the essence of enterprise services has not changed, only that the service form constituting enterprise infrastructure has evolved to data services presented in the cloud. After the cloud service sector enters a new stage, the basic drivers for the development of the SaaS industry will also change fundamentally. In the future, SaaS development will still feature three key words: protracted war, positional warfare, and tough battle. By protracted war, the incubation period of an SaaS company from being a start-up to becoming established is relatively long, so it should be prepared for a protracted war; by positional warfare, an SaaS company has to work step by step and constantly improve product functions to gradually accumulate medium and large benchmark customers; by tough battle, since it is difficult to establish product barriers and defense challenges with pure SaaS products, how to adapt to the business model of large enterprises and establish its own defense wall is a subject that needs to be tackled continuously. For SaaS enterprises, no matter how well these "three battles" are fought, it is certain that AI, multi-module integration, mobility and self-built PaaS platforms are undoubtedly the four development trends in the industry. Before the industry has yet to enter the close combat stage, they need to focus on the future, step up R&D efforts and bet on the racetrack.

News